The Dubai Multi Commodities Center (DMCC) free zone has recently announced a change in the DMCC audit deadline for the 2024 financial year. The previous deadline was June 30, 2024, but it has now been extended to September 30, 2024. This extended DMCC Audit Deadline 2024 gives businesses more time to prepare and file their audit reports properly. The extra time should help these companies avoid any mistakes in their financial reporting.

This adjustment of the DMCC Audit Deadline 2024 will also be good for businesses since it will enable them to demonstrate that their financial statements are prepared according to the DMCC-approved standard after working with DMCC approved auditors for a longer time. One such firm is Intellect Chartered Accountants, which has been ranked as one of the highly rated DMCC Approved Auditors in the region owing to its experience in handling DMCC audit requirements.

About DMCC

The Dubai Multi Commodities Centre is one of the prominent free zones in Dubai. It is especially known for offering diverse business services, with a focus on the commodities trading sector. DMCC was created to facilitate trade flows and offers a very strong regulatory environment, supportive policies, and infrastructure for all businesses.

DMCC Audits Deadline 2024 Extended to September 30, 2024

The DMCC has now made it official that the DMCC audit for the financial year 2024 will be accepted till September 30, 2024. This change in the DMCC audit deadline of June 30, 2024, seeks to give more time to prepare and file their audited accounts.

Reason for this Extension

The DMCC Audit Deadline 2024 has been extended to help businesses that need more time to sort out their finances. This is because checking finances can be complicated. DMCC is also showing its support for its member companies by giving them more time to be transparent and honest about their finances.

What Happens If You Don’t Finish Your DMCC Audit On Time

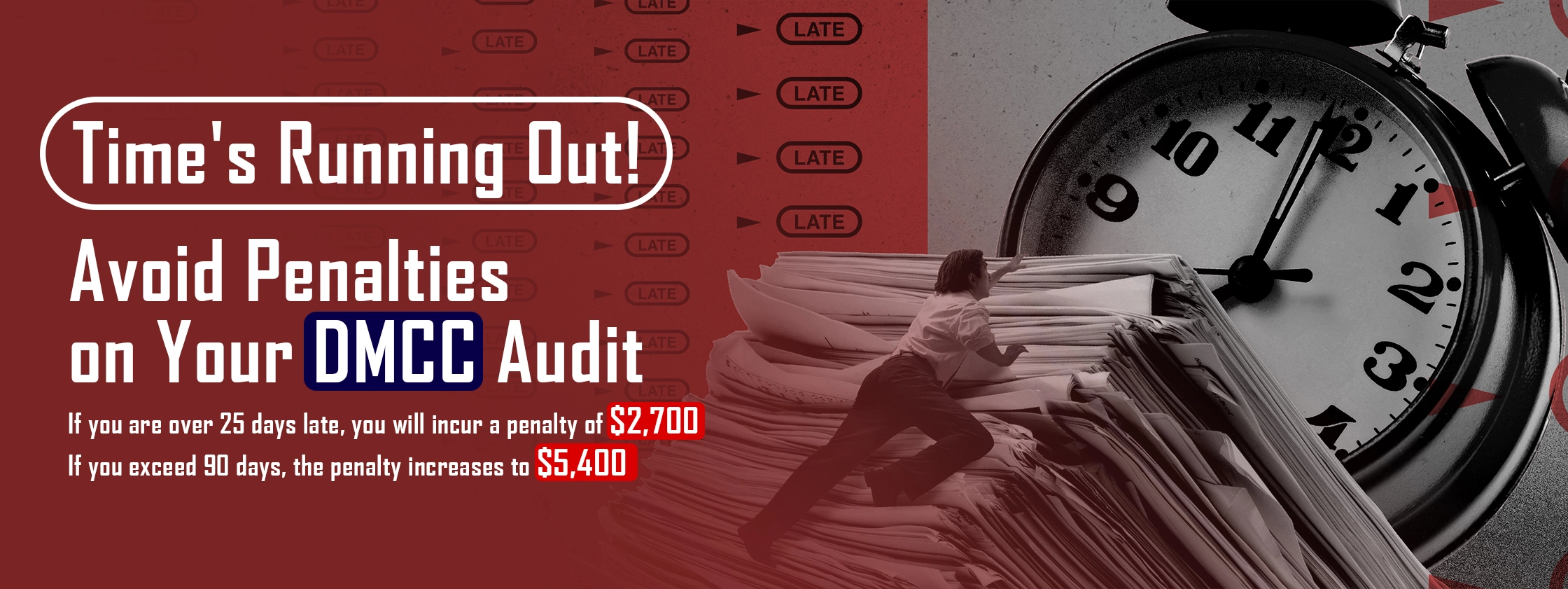

If you don’t finish your DMCC audit on time, you will have to pay a penalty. Here is the amount you have to pay if you miss DMCC audit deadlines:

- If you are more than 25 days late, you will pay $2,700

- If you are more than 90 days late, you will pay $5,400

Why meeting the DMCC audit deadline in 2024 is important

- It helps to keep your business finances transparent and verified.

- It makes sure that you are following all the rules and regulations.

- It provides a clear picture of the financial state of your business to the stakeholders (such as investors and partners).

- It helps you to find any financial mistakes or errors and fix those mistakes and errors.

- It shows that your business is responsible & follows all the UAE rules and regulations.

- When you work on your DMCC audit on time, you are proving that you are dedicated to behaving properly.

How to Choose the Right DMCC Auditor

When choosing a DMCC auditor, it is important to pick the right one. Here is what to look for:

- Make sure they are Approved Auditors in DMCC.

- Check the reputation and record

- Choose an auditor who has proper knowledge of your industry

- Strong client reviews for the auditor

Steps to Prepare for the DMCC Audit

- Gather Financial Documents: Collect all the important financial records and statements.

- Reconcile Accounts: Make sure all accounts are reconciled and correct.

- Review Compliance: Check that all the regulatory requirements are met.

- Engage an Approved Auditor: Select a DMCC-approved auditor, such as Intellect Chartered Accountants.

- Submit on Time: Try to send the audited financial statements well before the DMCC Audit Deadline 2024.

About Intellect Chartered Accountants

Account Number: 435137

DMCC Approved Auditor: Intellect Chartered Accountants is an officially approved auditor by DMCC. You can check a DMCC Approved Auditors List 2024 for your reference.

Experienced Team: Our experienced team of auditors and financial experts provides the best services for financial improvements.

Services: Intellect Chartered Accountants provides a comprehensive range of services including audit & assurance, auditing, accounting and bookkeeping, business consultancy, VAT consultancy, and Banking services.

Contact Information: Contact details for Intellect Chartered Accountants

Website – https://intellectca.ae/

Phone – +971-4-2229911

Email – info@intellectca.ae

Address – 807, Clover Bay Tower, Business Bay, Dubai, UAE